Tanzania has impressively outperformed its goal of attracting five million tourists by 2025, welcoming 5.3 million visitors by April of that year. This accomplishment represents a seven percent increase over the original target and was reached three months ahead of the fiscal year’s end, showcasing the country’s rapid growth and rising status as a premier travel destination in Africa.

After the global disruptions caused by the Covid-19 pandemic, Tanzania’s tourism sector has demonstrated exceptional resilience and recovery. This success stems from targeted promotional campaigns, infrastructure enhancements, and strategic collaborations that have effectively drawn visitors from across the globe, fueling steady increases in both tourist numbers and revenue.

A major driver behind this surge is the growing influx of travelers from China. In the current fiscal year, approximately seventy-one thousand tourists from the Far East journeyed to Tanzania, encouraged in part by a popular travel documentary titled Amazing Tanzania. The film, which features well-known Chinese actors, vividly portrays Tanzania’s breathtaking scenery, diverse wildlife, and rich cultural heritage, significantly boosting interest and travel bookings among Chinese audiences.

India also remains a crucial source market for Tanzania’s tourism. In 2024 alone, over sixty-three thousand Indian tourists visited the country, with demand remaining strong as bookings for upcoming years, including 2026 through 2028, continue to fill rapidly. This indicates a growing confidence in Tanzania’s travel offerings and its appeal as a long-term destination.

From an economic perspective, tourism remains a cornerstone of Tanzania’s growth strategy. Revenues have surged from USD 1.3 billion in 2021 to more than USD 3.9 billion in 2024. Key institutions such as Tanzania National Park (TANAPA), Ngorongoro Conservation Area (NCA), Tanzania Wildlife Management Authority (TAWA), and the Ministry of Natural Resources and Tourism’s digital platforms have collectively generated 912.9 billion Tanzanian shillings, surpassing ninety-four percent of the annual revenue target well before the fiscal year’s close.

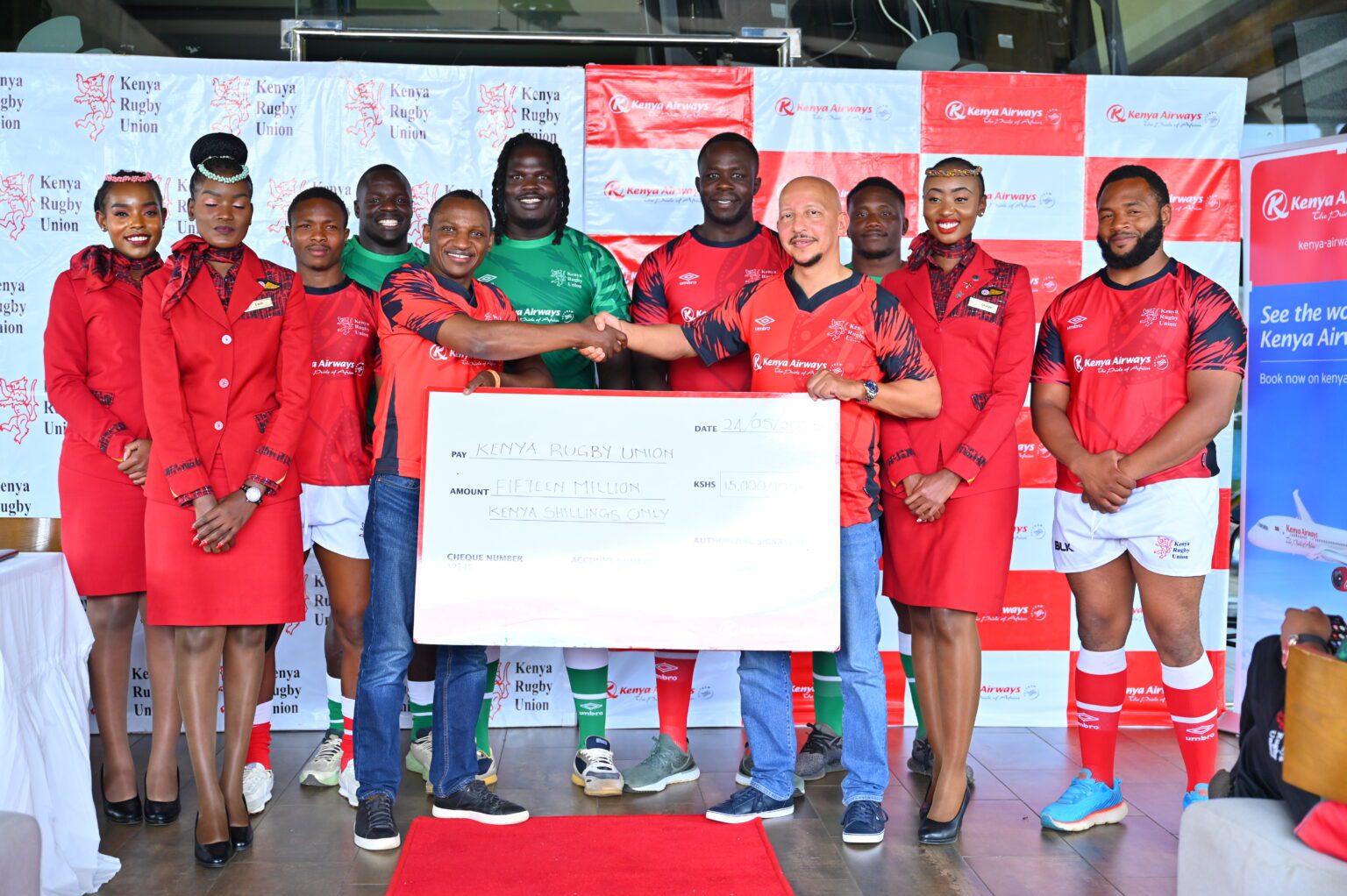

To sustain this momentum, Tanzania continues to actively promote its attractions through partnerships with international airlines, hosting high-profile sporting events, producing engaging travel documentaries, and organizing special cultural festivities. These efforts broaden the country’s appeal and attract a diverse range of international visitors.

In a prestigious recognition of its growing prominence, Tanzania will host the 2025 World Travel Awards (WTA) gala ceremony in Dar es Salaam, the commercial hub. Scheduled for June 28, 2025, at the Johari Rotana Hotel, this event will honor leading tourism operators from across Africa and the Indian Ocean region, further highlighting Tanzania’s key role in the continent’s travel industry.

Policy reforms have also contributed to the sector’s vitality. Unnecessary fees and tariffs that previously posed challenges for investors, tour operators, and other stakeholders have been eliminated. For example, park entry fees for licensed tour guides have been removed, provided they hold official accreditation. These measures reduce operational costs and enhance the visitor experience, fostering industry growth.

Tanzania’s remarkable achievements reinforce its status as a top-tier African tourism destination. The country’s abundant natural beauty—from iconic national parks and wildlife reserves to vibrant cultural sites—continues to captivate travelers worldwide. This sustained tourism expansion not only bolsters the national economy but also elevates Tanzania’s global reputation.

Looking forward, Tanzania is committed to sustainable tourism that balances economic development with environmental stewardship and community welfare. This approach ensures that its unique heritage is preserved for future generations while maintaining unforgettable experiences for visitors.

In summary, Tanzania’s early surpassing of its five million tourist goal marks a significant milestone. Backed by innovative marketing, strong international demand, and progressive reforms, the nation is well-positioned to maintain its upward trajectory and solidify its place as one of Africa’s most sought-after travel destinations in the coming years.

Source: TravelandTourWorld