The travel industry in Kenya is on an upward trajectory and as a result the travel payments landscape is taking shape. The International Air Transport Association (IATA) reports that in 2024, Kenya contributed 2.67% of the total Middle East and Africa sales, with gross ticket sales of $ 566.8 million, reflecting a 2.11% growth ($11.7 million increase). This translates to over Ksh. 73 billion, which places the industry as a key contributor to the national economy. Beyond the numbers, this growth also implies millions, if not billions, of payment transactions within the industry annually.

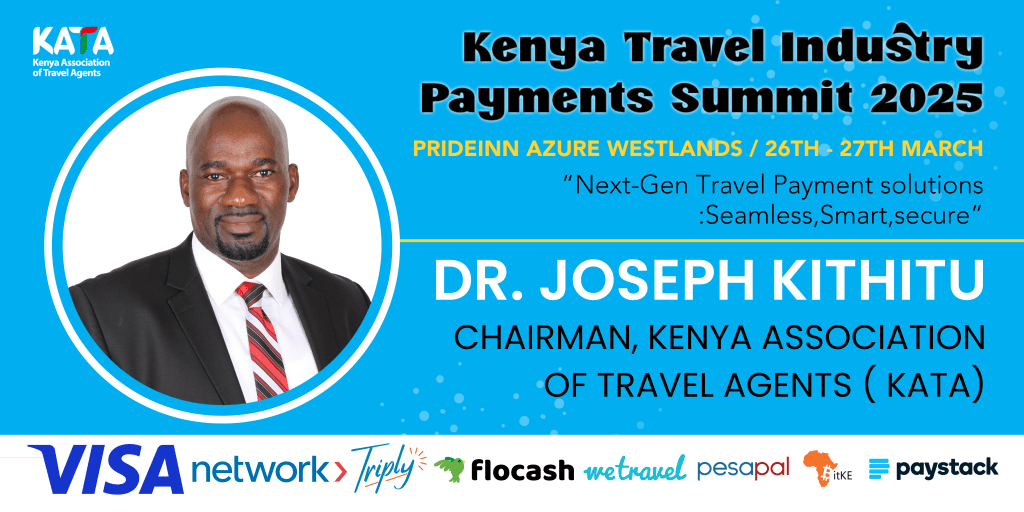

KATA Chairman, Dr. Joseph Kithitu, underscores the fundamental role of payments in commerce. At the inaugural Kenya Travel Industry Payment Summit (KTRIPS), he noted, “For any business transaction to be complete, someone has to pay the other.“. His simple yet powerful statement highlights why understanding and adapting to modern payment solutions is essential for the industry’s continued success. The 2024 event convened stakeholders including travel industry leaders, financial institutions, technology providers, and regulatory experts in the travel industry focused on one objective – Exploring the Kenyan Travel Industry Payments Landscape.

The payment system in the travel industry has evolved immensely and now we are in a digital era that prioritizes convenience and security of travelers as they make payments. At this point, it is only prudent to acknowledge that tech-based payment solutions are at the forefront of this quest. The convergence of technology and traditional payment methods has bred cutting-edge solutions for the industry.The Kenya Association of Travel Agents (KATA) led by the CEO Nicanor Sabula, the board and a secretariat of forward-thinking individuals, remains steadfast in its commitment to ensuring members stay ahead of industry shifts. The association actively advocates for the rapid adoption of emerging payment solutions, reinforcing the need for continuous learning and adaptation. Dr. Kithitu’s message to over 300 KATA members is clear “If we do not keep learning, we will extinguish hence we should not be any lesser.”

This philosophy is what drives the association to host the two-day yearly payment summit to allow solution providers to present these solutions to the target audience directly for efficient use, better customer service, and ultimately business growth. The 2024 summit featured partnerships with leading organizations such as Absa Group, DPO Pay by Network, We Travel, Brij, Union Pay International, Buupass, Intasend, BitKE, and Paystack. Travel agents in attendance gained valuable insights and access to cutting-edge payment solutions, further streamlining their operations and enhancing their customer service.

As the industry gears up for KTRIPS 2025, expectations are high. KATA remains dedicated to fostering a conducive business environment for its members by keeping them informed about the latest developments in payment solutions. The Kenya Travel Industry Payments Summit (KTRIPS 2025) is set to redefine the travel payments landscape on March 26th and 27th at PrideInn Azure, Westlands, Nairobi. With the theme “Unveiling Next-Gen Travel Payment Solutions: Smart, Secure, and Seamless,” the summit will bring together top fintech leaders, payment experts, and travel industry stakeholders to explore groundbreaking innovations shaping the future of digital transactions.

The Event brings together a powerful lineup of industry experts, fintech leaders, and travel payment innovators who are shaping the future of financial transactions in travel. From global payment giants like Visa, DPO Pay by Network ,Flocash,and Pesapay to regulatory authorities such as the Central Bank of Kenya, these speakers will provide critical insights into digital payment innovations, cybersecurity, blockchain, AI-driven automation, and compliance strategies. Attendees will hear from visionaries like Raman Arora (Visa), Ali Hussein Kassim (Association of Fintechs in Kenya), and Sirak Mussie (Flocash), alongside travel payment disruptors like Peter Wachira (Triply) , Christine Kitale (Pesaswap) and others. With expertise spanning B2B payments, financial regulation, and digital commerce, these thought leaders will equip travel businesses with the knowledge to adopt smarter, more secure, and seamless financial solutions.