Airspace liberalisation between five East African Community member countries of Rwanda, Uganda, Kenya, Tanzania and Burundi could result in an additional 46,320 jobs and $202.1 million (approx: Rwf 164.5 billion) annually in GDP, according to a study on the economic impact of liberalisation.

Airspace liberalisation between five East African Community member countries of Rwanda, Uganda, Kenya, Tanzania and Burundi could result in an additional 46,320 jobs and $202.1 million (approx: Rwf 164.5 billion) annually in GDP, according to a study on the economic impact of liberalisation.The September 2016 policy briefing by the East African Business Council (EABC) and the East Africa Research Fund (EARF) says a substantial body of research has repeatedly found that aviation liberalisation has led to increased traffic volumes, greater connectivity and choice, and lower fares.“Quantitative analysis, based on data from East Africa, provided robust and compelling evidence that liberalisation leads to 9% lower average fares and a 41% increase in frequencies, which in turn stimulate passenger demand,” the study said.

The EABC Executive Director Lilian Awinja, last week, informed members of the East African Legislative Assembly (EALA) that the business community is “very concerned” about the high cost of air transport attributed to the slow pace of liberalisation .She said flight costs, both passengers and cargo, are high and thus contributing to a high cost of doing business.Awinja said: “Despite the commitments of Partner States at the international level, and the integration efforts through the Common Market at the regional level involving liberalisation of services, the EAC domestic air transport sector remains over-protected.”This over-protection, she explained, translates into less accessible and unaffordable air transport at the expense of potential users.Also worrisome, Awinja said, is the time it takes to move around the region by air.

The apex body of regional businesses and corporates carried out a study on the costs and benefits of open skies and is set to provide more details on the issue during a validation workshop in April.Richard Ndahiro, a Uganda-based regional financial services professional, told The New Times that: “Air tickets in EAC are prohibitively expensive; it costs $15 to travel by bus from Kigali to Kampala, and $300 by air. One is painfully forced to sit on a bus for a 10-hour journey, instead of a 45 minute flight.”“A road passenger travelling to Kampala has to forego two days of travel, considering the return trip. The Entebbe-Nairobi flight of 50 minutes is almost the cost of flying to Dubai,” Ndahiro said, adding that the latter costs $500 on an Emirates flight. Disregarding possible connecting flights, Entebbe is nearly 2,300 miles away from Dubai while Entebbe is “a stone throw away” from Nairobi.“We are slowly moving away from an era where essential services like communication, and banking were priced to become elitist. Why not air transport? With the right pricing, passengers will opt to fly than endure long road trips.”Concerned by his nearly 10-hour flight from Arusha, in Tanzania to Kigali, Daniel Kidega, the EALA Speaker, promised the Assembly will help push for things to get better. He said the Assembly will bring to task the Council of Ministers, the bloc’s central decision-making and governing organ, to explain what the EAC Civil Aviation Safety and Security Oversight Agency (CASSOA) is doing to domesticate the region’s airspace.

The EABC is appealing for adoption and operationalisation of the EAC air transport regulations by all Partner States to be expedited. It requests that harmonisation of regulatory fees and charges be done in the region in order to have a level playing field, and urges countries to provide national treatment to EAC national air operators, passengers and cargo in all the countries.Eunice Muhoro, a Kenyan trader, told The New Times that, recently, increased demand for air cargo services within east Africa has been witnessed and there was a shortage to intercity or inter-regional air capacity to move fruits and vegetables for export.She explained that there is need to have 10-20 tonne freighters to handle consolidated cargo in the region “hence the need to implement the Fifth Freedom among Partner States to minimise air transport costs and increase flights’ turnaround.”Fifth freedom is the right to carry passengers from one’s own country to a second country, and from that country to a third country, and so on. Muhoro said: “This is the time to transform our region into a global asset, reduce transport costs, grow our economy, and significantly improve quality of life for our citizens, making east Africa truly the place to live, work, raise families and do business.”Neglected, under-researched, under-exploited. A joint UK Department for International Development (DfID)-EAC research proposal on the costs and benefits of ‘open skies’ in the bloc notes that while there are many benefits to economic development from open air markets in other parts of the world, in the EAC the sector has remained neglected, under-researched and under-exploited.

Although there has been progress through the development of regulations in the 1990s governing trade air transport services in the EAC known as the Bilateral Air Services Agreements (BASAs), studies indicated that BASAs are restrictive and uncompetitive. The research proposal notes that ownership issues have caused most concern for EAC countries and airlines, where airlines may be deemed national carriers but are not majority owned by African nationals. Fastjet, a British-based holding company for a group of low-cost carriers operating in Africa, is used as an example. It is noted that, while under Tanzanian law, Fastjet is a Tanzanian carrier, other countries do not accept the designation because under their own national legislation, that designation would require ownership (or majority ownership) by Tanzanian nationals.Implications for region.

According to the EABC-EARF policy briefing note, a substantial body of evidence has developed over the last 10-15 years examining the impacts of BASA liberalization for both the aviation sector and the wider economy. Studies from around the globe found that liberalization allowed new carriers to enter the market and “existing carriers to better respond to demand. ” This resulted in lower fares for passengers and more travelers being able to access air services. However, more recently, research has found similar effects occurring in Africa where governments have chosen to remove restrictions on air services,” reads the policy brief. The document also emphasises that benefits of air service liberalization extend well beyond the aviation industry and passengers and contributes to greater trade and tourism, inward investment, productivity growth, increased employment and economic development.

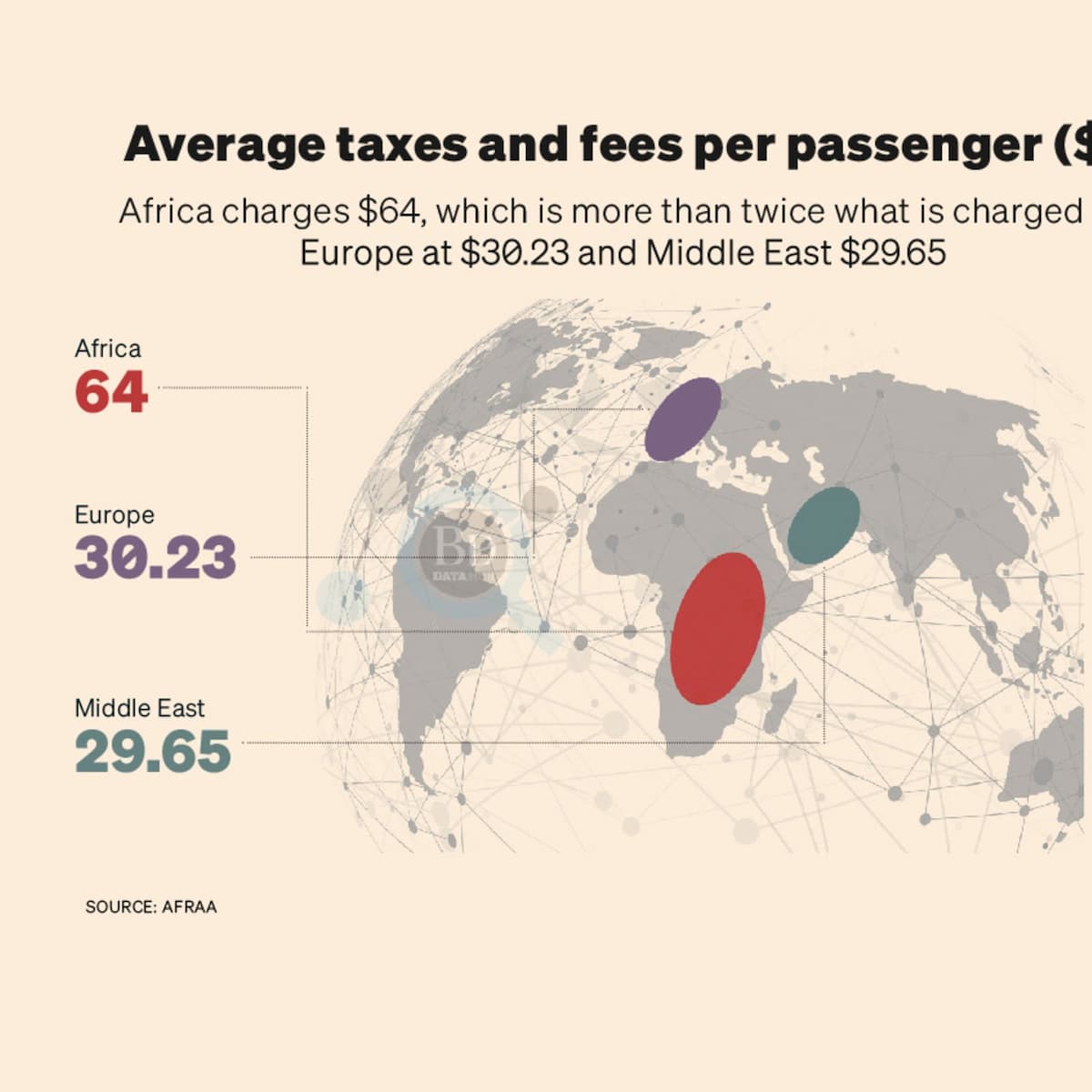

Liberalization of airspace would definitely be a catalyst for more people traveling by air and thus boosting tourism, agreed Davidson Mugisha, Director of Wildlife Tours Rwanda, a local tour operator. Mugisha added: “Many people think that air travel is a privilege of the few. A return Kigali-Entebbe flight costs around $300. That’s a lot of money for a 30-minute flight. “The more people afford air transport, he said, the more tourist revenues and this would “positively impact on the sector’s infrastructure development so that we accommodate the increased demand” and, this too comes with additional economic benefits. During the recent Aviation Africa 2017 forum, held in Kigali, aviation experts said that airlines in Africa reported a loss of about $800 million in 2016 – with similar projections this year – largely due to regulation of African airspace. Dr Elijah Chingosho, the secretary general of African Airlines Association, said this is a major stumbling block limiting growth and leading to closure of some airlines. Only about 17 African countries liberalized their

Source: New Times