The conversation at the 4th Global Tourism Resilience Day Conference and Expo was not about recovery. It was about redesign.

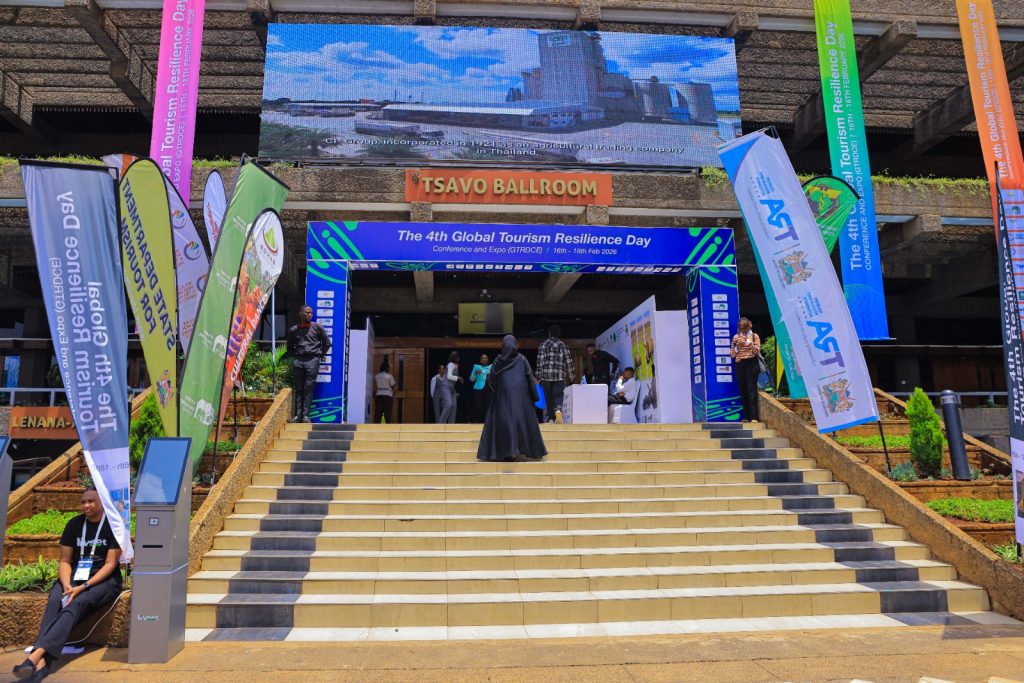

Held from 16–18 February 2026 at the iconic Kenyatta International Convention Centre (KICC), the summit convened more than 400 delegates from across Africa, the Caribbean, Europe, and the Americas under the theme “Tourism Resilience in Action: From Crisis Response to Impactful Transformation.” Ministers, policymakers, private sector executives, academics, and development partners gathered with a shared understanding: crisis response is no longer sufficient for an industry repeatedly battered by pandemics, climate shocks, geopolitical instability, and economic volatility.

What is required now is structural reform — financial, environmental, institutional, and diplomatic.

Diplomacy and Tourism Intersect

The summit’s significance was underscored by the presence of Musalia Mudavadi, Kenya’s Prime Cabinet Secretary and Cabinet Secretary for Foreign and Diaspora Affairs, who linked tourism resilience to economic diplomacy.

Mudavadi emphasized that tourism is not only a cultural bridge but a pillar of foreign exchange earnings, regional integration and international partnerships. He noted that strengthening resilience mechanisms enhances investor confidence and positions Kenya as a stable, forward-looking destination in a competitive global marketplace.

By aligning tourism policy with Kenya’s broader foreign policy objectives, he argued, the country can leverage multilateral partnerships to mobilize climate finance, technical support, and market access for its tourism sector.

Resilience as Economic Safeguard

Opening the conference, Tourism and Wildlife Cabinet Secretary Rebecca Miano framed resilience not as a slogan but as an economic safeguard.

She outlined Kenya’s strategy to embed climate adaptation into tourism planning frameworks, strengthen disaster-risk reduction systems, invest in digital transformation across tourism enterprises, and improve coordination between national and county governments.

Preparedness, she stressed, must be institutionalized before the next shock hits.

From the Caribbean, Edmund Bartlett of Jamaica reinforced the urgency. A leading architect of the global tourism resilience movement, Bartlett renewed his call for the operationalization of a Global Tourism Resilience Fund and innovative catastrophe insurance mechanisms to cushion destinations against climate and disaster-related losses.

Without financial buffers, he warned, recovery becomes cyclical and costly — especially for developing economies heavily reliant on visitor receipts.

The Implementation Gap

While the rhetoric was ambitious, the summit’s most candid conversations centered on execution.

In a high-level discussion moderated by Nicanor Sabula, CEO of the Kenya Association of Travel Agents (KATA), industry leaders confronted a persistent gap: national tourism strategies often fail to translate into tangible impact at community and enterprise levels.

Sabula challenged panelists to move beyond policy declarations and ensure that resilience frameworks are operationalized within travel agencies, tour operations, hospitality enterprises, and destination management systems.

Travel agents, he noted, are often the first line of response during crises — coordinating cancellations, rebookings, and traveler communication. Yet they frequently lack access to integrated data systems and coordinated risk protocols.

“Resilience must live at enterprise level,” one delegate observed — a sentiment echoed across sessions.

SMEs and Access to Finance

A recurring theme was the vulnerability of small and medium enterprises (SMEs), which form the backbone of tourism value chains but remain constrained by limited access to affordable finance.

Prof. Mary Gikungu of the National Museums of Kenya and Mike Macharia of the Kenya Association of Hotelkeepers & Caterers called for targeted credit facilities, blended financing instruments and domestic tourism stimulus programs to enhance business continuity.

Fred Kaigua of the Kenya Association of Tour Operators emphasized the importance of harmonized regional travel frameworks and improved intra-African connectivity to reduce dependence on long-haul markets and buffer destinations against global volatility.

Gender Equity as a Strategic Imperative

Leadership equity also featured prominently.

Data shared by the Jamaica Tourist Board showed that women represent more than half of the global tourism workforce, yet remain underrepresented in executive leadership and capital ownership.

Delegates from the Kenya Association of Women in Tourism argued that closing this gap is not simply a social imperative — it is a resilience strategy. Diverse leadership structures, they noted, strengthen institutional depth, improve crisis decision-making and expand innovation capacity.

Nature-Based Tourism Under Review

Nature-based tourism — Kenya’s signature product — was examined through a resilience lens.

Conservation leaders warned that wildlife-dependent economies remain exposed to ecological shocks, including prolonged droughts, biodiversity loss, and human-wildlife conflict. They called for science-led planning, climate modeling, and data-driven forecasting to be integrated at the earliest stages of tourism investment and conservation planning.

Strengthening collaboration between conservation agencies, private conservancies, hospitality operators, and research institutions, they argued, will reduce long-term vulnerability.

Digital Resilience and Emerging Threats

Beyond environmental and financial risk, digital vulnerabilities surfaced as an emerging frontier.

Delegates discussed cybersecurity threats, misinformation risks and the sector’s growing dependence on digital booking ecosystems. Strengthening digital infrastructure and trust systems, Bartlett noted, is now central to safeguarding destination reputations.

Across panels, one concept resonated: partnership is infrastructure.

Public and private actors must share intelligence, coordinate risk planning and co-invest in sustainable growth models. Resilience cannot be siloed within ministries; it must be embedded across regulatory systems, financial markets, conservation frameworks and enterprise networks.

The Nairobi Declaration and Field Excursions

A major outcome of the summit was the adoption of the Nairobi Declaration on Global Tourism Resilience, calling on governments to institutionalize resilience metrics within tourism master plans and establish dedicated financing instruments.

Importantly, the dialogue extended beyond conference halls.

Delegates participated in curated excursions to the Nairobi National Park, Nairobi city nightlife, Agri-tourism products, and hospitality enterprises across the city, observing resilience practices firsthand. These visits highlighted revenue-sharing conservation models, youth-led innovation initiatives, and sustainable tourism operations designed to withstand environmental and economic shocks.

For many international participants, the excursions reinforced the summit’s central thesis: resilience must be lived, not merely legislated.

Nairobi as a Global Policy Laboratory

For Kenya, hosting the summit was as much about leadership as logistics.

With senior government officials, including Mudavadi and Miano, articulating a whole-of-government approach, Nairobi positioned itself not merely as a destination of choice but as a policy laboratory influencing how global tourism prepares for uncertainty.

The tone throughout the three-day gathering was pragmatic rather than ceremonial.

Resilience, delegates agreed, is no longer about bouncing back.

It is about building systems strong enough to bend — and smart enough to evolve.