A new study by European aircraft manufacturer Airbus indicates that West Africa holds the potential for an aviation revolution, leveraging its booming population, diverse economies and strategic geographical position to open new routes.

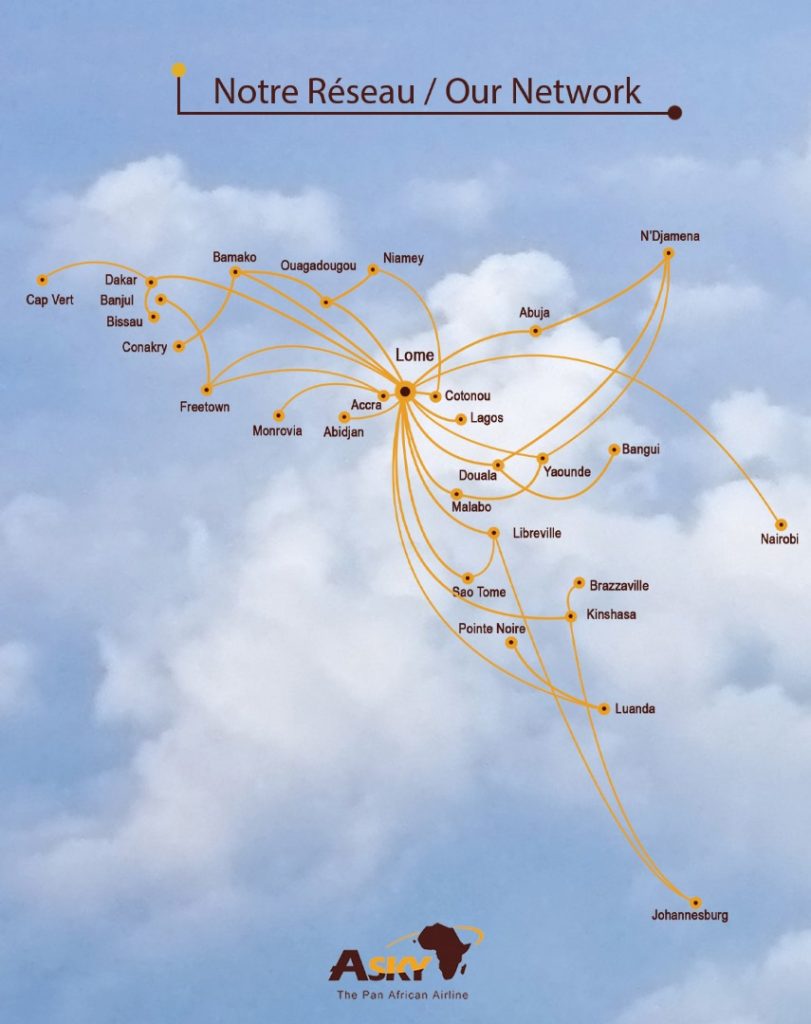

The study, ‘Exploring the horizons: A study of unserved air routes to, from and within Africa,’ highlights that nine out of the top 15 unserved routes start or end in West Africa.

These routes represent significant opportunities for airlines in the region. They include Lagos-New York, Abuja-Nairobi and Dakar-Libreville.

“It is surprising to observe that throughout the entirety of 2023 and up to the conclusion of the IATA-summer in 2024, merely two routes connected Nigeria with North America,” the Airbus study says.

“And both routes were operated by non-Nigerian operators: Lagos-Atlanta, operated by Delta Air Lines, and Lagos-Washington, operated by United Airlines.

“What is particularly remarkable is that during the same period, the whole region of West Africa only had three entry-points in North America: Atlanta, New York and Washington.”

Beyond West Africa, other cities across the continent considered “most appealing unserved routes” link cities such as Cape Town, Nairobi, Dakar and Douala.

At the top of the list of unserved routes in Africa are long-haul intercontinental flights connecting the continent to North America, Europe and the Indian subcontinent.

These routes highlight crucial gaps in air travel, driven by high demand for direct flights from major African cities to global hubs. Currently, passengers endure time-consuming connecting flights, adding unnecessary inconvenience to their journeys.

This is even as projections by the African Airlines Association show African airlines are likely to cross the 100 million passengers mark for the first time in 2025, a sign of the growing traffic volumes in the country’s aviation sector.

Afraa says passenger numbers will hit 98 million by the close of year, which is a 15 per cent increase from 2023, before hitting beyond the 100 million mark by 2025.

Airbus projects a 4.1 per cent annual growth in air traffic over the next 20 years, leading to a demand for 1,180 new aircraft in Africa by 2043.

Despite challenges, the study highlights the potential for greater air travel efficiency through improved connectivity and optimised flight paths, promising reduced travel times and costs.

Notable progress is already underway, with several airlines expanding to cover new routes within Africa and beyond. Ethiopian Airlines is leading the charge, aiming for a 30 per cent growth in passenger numbers by mid-2024.

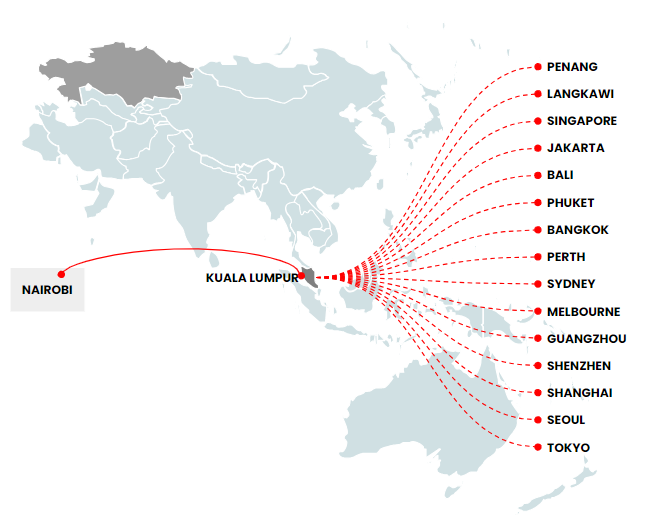

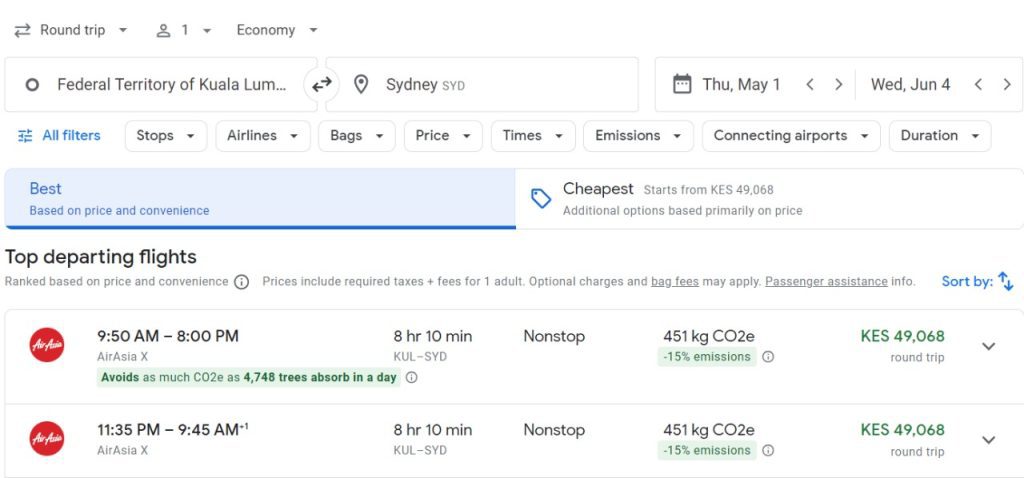

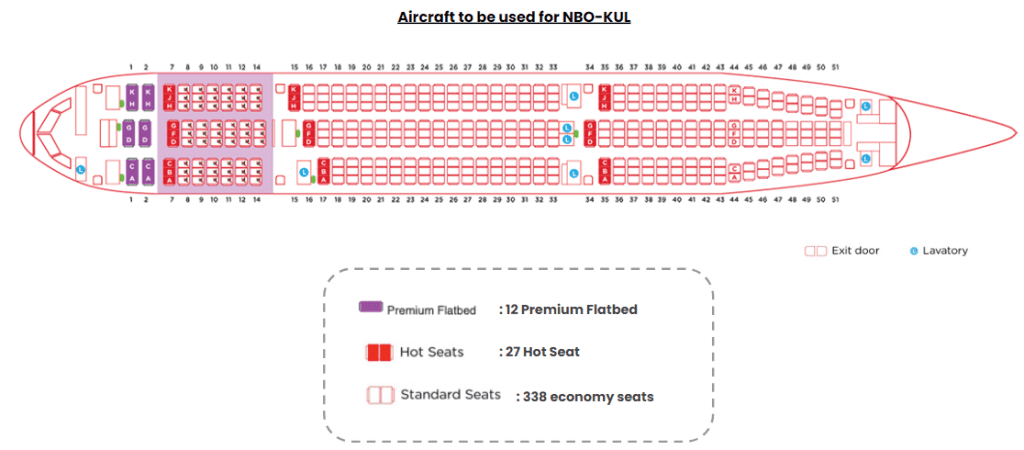

More foreign airlines are also increasingly expanding into new African routes. For instance, AirAsia, a leading Asian carrier, has announced a direct route to Kuala Lumpur, Malaysia, starting in November.

This new intercontinental route eliminates the need for long layovers, offering travellers an effortless journey between East Africa and Asia.

The ongoing expansions are yielding results, with IATA projecting Africa’s airlines to earn a collective net profit in 2024 for the second consecutive year, showcasing the sector’s impressive post-pandemic resilience.

The Airbus report suggests creating direct long-haul routes between several other key destinations. These include routes from Harare to London, Johannesburg to Mumbai, Entebbe to London, Cape Town to Brussels, Durban to London, and Nairobi to Washington.

The report also proposes flights from Lagos to multiple North American cities, such as Manchester, New York, Toronto and Houston.

While the authors acknowledge that unserved city pairs within the continent rank relatively lower in terms of economic feasibility due to lower traffic numbers, there are promising prospects, such as between the Cape Town-Lagos route.

“Given the pivotal roles played by both Lagos (Nigeria) and Cape Town (South Africa) within their respective countries and across the African continent, the establishment of a non-stop service between these cities emerges as a sensible case,” the authors say.

“Despite the significance of both cities, there is currently no non-stop flight between them. Historical schedule data indicate that such a service has never existed. Moreover, there is no direct air service connecting Cape Town with the entire subregion of West Africa.”

Other high-potential intra-continental routes that the report identifies include Dakar-Libreville, Abidjan-Douala, Abuja-Nairobi and Dakar-Douala.

However, according to experts, efforts to ensure visa-free travel for Africans will create a real impact in easing travel, especially at the regional level.

New South Institute research fellow Alan Hirsch said by the end of 2022, only 27 per cent of African routes allowed visa-free travel for Africans.

“Regularising freer movement of people across African borders is one of the continent’s great developmental challenges. It is one of the flagship projects of the African Union’s Agenda 2063,” he said.

Hirsch is also an emeritus professor at the Nelson Mandela School of Public Governance at the University of Cape Town.

Source: The Star.