Dubai, United Arab Emirates: Dubai Calendar, the city’s official event listings platform, has unveiled a diverse range of events for October 2024, showcasing thrilling sports competitions, captivating live performances, and engaging community activities. October promises a month filled with unforgettable experiences for all, including shows by global music icons and thrilling athletic performances that will have everyone on the edge of their seat. From the legendary British band Kasabian to the Grammy Award winner Calvin Harris, and the dazzling performance of Cinderella on Ice, prepare for a month filled with excitement and entertainment like never before!

Below are Dubai Calendar’s top picks of upcoming events for October:

COMMUNITY

Global Village

Date: 16 October – 11 May

Location: Global Village

About: Global Village is reopening its gates for its 29th season. Featuring 26 pavilions with 3,500 displays from countries near and far, visitors can pick up traditional handicrafts and snacks from more than 200 eateries. Highlights include mesmerising fire-breathing performances, star-studded concerts, and exhilarating stunt shows, ensuring there is something exciting for everyone.

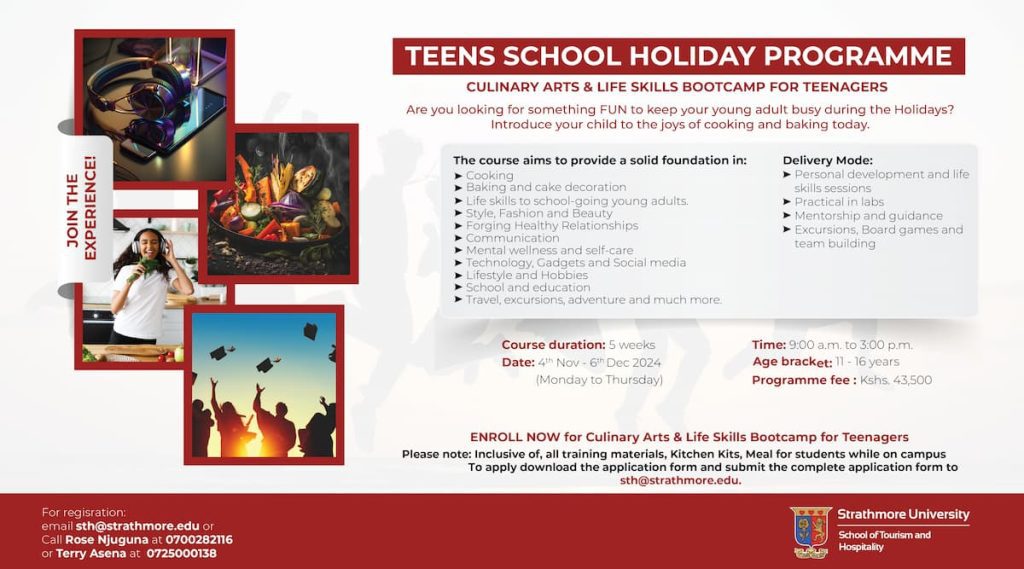

Gault and Millau Culinary Innovators

Date: 24 – 26 October

Location: ICD Brookfield Place

About: Prepare for an extraordinary culinary experience as Dubai’s talented chefs unite for Gault&Millau’s inaugural Culinary Innovators showcase. This unique event, a first of its kind in the UAE, brings together 12 of Dubai’s most acclaimed chefs for a spectacular three-night pop-up.

SPORTS

Dubai Basketball Club

Date: 22 September – 31 May

Location: Coca-Cola Arena

About: Grab your seats as Dubai’s new basketball team begins its 2024/5 season. Get courtside as Dubai Basketball takes on reigning ABA League champions Crvena Zvezda (Red Star) from Serbia. Led by renowned Head Coach Jurica Golemac, Dubai’s roster includes players from across the world, including the United States and the Philippines.

Dubai Muscle Show

Date: 25-27 October

Location: Dubai Exhibition Centre, Expo City Dubai

About: Join the latest edition of the Dubai Muscle Show, the Middle East’s leading fitness and bodybuilding platform. Highlights include the Dubai Muscle Classic with the FMG International’s first women’s contest, intense boxing and Muay Thai matches, and inspiring talks with bodybuilding legends.

Dubai Active

Date: 25-27 October

Location: Dubai Exhibition Centre, Expo City Dubai

About: Start the Dubai Fitness Challenge with Dubai Active. Enjoy workouts with celebrity trainers, watch boxing and MMA, and explore more than 400 brands.

Cancer Awareness Cycle or Walk

Date: 26 October

Location: Meydan Cycle Track

About: Put your best foot forward for the latest edition of Cycle or Walk For Life and plan a family day out. This community event aims to bring people together to spread awareness about cancer while enjoying live entertainment by local bands, dance groups, motivational speakers, a kids’ zone and festive food stalls.

Plus500 City Half Marathon

Date: 27 October

Location: Gate Village, Dubai International Financial Centre

About: Experience stunning views at the Plus500 City Half Marathon racing through Downtown Dubai’s iconic landmarks like Burj Khalifa and Emirates Towers. Choose between 21km, 10km, or 5km routes, and enjoy a scenic run with friends and family.

Dubai Fitness Challenge

Date: 26 October – 24 November

Location: Citywide

About: Get ready for the 2024 Dubai Fitness Challenge. Complete 30 minutes of daily activity for 30 days with free classes and events in yoga, cycling, high-intensity interval training, and more. Join the fun and get fit!

LIVE ENTERTAINMENT

Cinderella on Ice

Date: 4-6 October

Location: Zabeel Theatre, Jumeirah Zabeel Saray

About: Enjoy a dazzling performance of Cinderella on Ice with stunning skating and thrilling manoeuvres by the Imperial Ice Stars. Book your tickets now for this enchanting retelling of the classic tale.

Tamer Ashour and Elissa live

Date: 11 October

Location: Coca-Cola Arena

About: Get ready for a night of Arabic music as Lebanese sensation Elissa and Egyptian composer Tamer Ashour light up the stage at Coca-Cola Arena. Elissa, dubbed the ‘Queen of Emotions’, promises a captivating performance as she entertains fans with endless hits like Baddy Doub and Betghib Betrouh. Meanwhile, Ashour will mesmerise with favourites including Zikrayat Kaddab, Ekhtarna Leh, Thania Wahda, and Enta Ekhtart.

Umm Kulthum & The Golden Era

Date: 12-13 October

Location: Dubai Opera

About: Immerse yourself in the soul-stirring melodies of the late Egyptian singer, Umm Kulthum, in an unforgettable show at Dubai Opera. The evening promises to be a true spectacle where her celebrated performances will unfold on stage, enhanced by a live orchestra. Watch the digital and real worlds merge in an elevated ambience during this show.

Kasabian live

Date: 13 October

Location: Coca-Cola Arena

About: Get ready to rock with legendary British band Kasabian at Coca-Cola Arena. Watch them belt out their top songs such as Fire, Club Foot, and L.S.F.

L.A. Dance Project – Romeo & Juliet Suite

Date: 17-18 October

Location: Dubai Opera

About: Dance meets cinema and theatre in a captivating adaptation of Shakespeare’s iconic Romeo & Juliet. This innovative ballet brings the Bard’s tragic love story to life in a contemporary setting.

Eric Prydz HOLO live

Date: 18 October

Location: Expo City Arena

About: Swedish DJ Eric Prydz is bringing his sensational show HOLO to Dubai for the first time. This show will headline technological and musical innovation that merges music and 3D holographic projections for a one-of-a-kind experience.

Tyga live

Date: 19 October

Location: Coca-Cola Arena

About: It will be an evening filled with beats as globally-acclaimed rapper Tyga performs live at Coca-Cola Arena. The American star gained popularity for his repertoire of hits and celebrated collaborations with international names like Drake and Justin Bieber. Hear him belt out chart-topping singles like Taste, Swish, and The Motto.

Romesh Ranganathan live

Date: 25 October

Location: Coca-Cola Arena

About: Romesh Ranganathan’s 2022 show in Dubai was a sold-out success, so grab your tickets early for his upcoming performance. The stand-up comedy star gained popularity thanks to stints on numerous TV shows like The Apprentice: You’re Fired!, Play to the Whistle, and A League of Their Own.

Sophie Ellis-Bextor live

Date: 26 October

Location: Dubai Opera

About: Get ready for an evening that pops with Sophie Ellis-Bexter at Dubai Opera. The singer, songwriter and pop icon of the 2000s will perform her greatest hits including Murder on the Dance Floor and Groovejet (If This Ain’t Love).

KT Tunstall live

Date: 26 October

Location: The Tent, Bla Bla Dubai

About: Dubai fans have the chance to catch Scottish musician KT Tunstall live at Bla Bla Dubai. On the night, you can expect to hear her perform hits like Suddenly I See, Hold On, and 1000 Years.

Calvin Harris live

Date: 26 October

Location: Ushuaia Dubai Harbour Experience

About: Get a taste of Ibiza right here in Dubai as Grammy Award winner Calvin Harris marks the opening concert at Ushuaia Dubai Harbour Experience. Get ready to dance to hits like Summer, Feel So Close, and How Deep Is Your Love, while a special guest appearance by Tyson O’Brien makes it an unforgettable experience.

DJ Liu x Barasti

Date: 26 October

Location: Barasti Beach

About: It’s raining beats at Barasti as DJ Liu brings his epic set of deep house and future house music straight from Tomorrowland to Dubai. This electronic music star has been making waves in the international circuit and will now spin top tunes at the beachfront destination.

Dubai Calendar allows residents and tourists to discover all the events, festivals and experiences Dubai has to offer. For more information, please visit: www.visitdubai.com/en/whats-on/dubai-events-calendar.

-Ends-

About Dubai Department of Economy and Tourism (DET)

With the ultimate vision of making Dubai the world’s leading commercial centre, investment hub and tourism destination, Dubai Department of Economy and Tourism (DET) is mandated to support the Government in positioning the emirate as a major hub for global economy and tourism, and in boosting the city’s economic and tourism competitiveness indicators, in line with the goals of the Dubai Economic Agenda, D33, which aims to double the size of the emirate’s economy and consolidate its position among the top three global cities over the next decade.

Under this remit, DET is driving efforts to further enhance Dubai’s diversified, innovative service-based economy to attract top global talent, deliver a world-class business environment and accelerate productivity growth. Additionally, DET is supporting Dubai’s vision to become the world’s best city to live and work in by promoting its diverse destination proposition, unique lifestyle and outstanding quality of life, overall.

DET is the principal authority for planning, supervising, developing and marketing Dubai’s business and tourism sectors. It is also responsible for licensing and classifying all types of businesses, including hotels, tour operators and travel agents. The DET portfolio includes Dubai Economic Development Corporation (DEDC), Dubai Business Licence Corporation (DBLC), Dubai Corporation for Consumer Protection and Fair Trade (DCCPFT), Dubai SME, Dubai Corporation for Tourism and Commerce Marketing (DCTCM), Dubai Festivals and Retail Establishment (DFRE) and Dubai College of Tourism (DCT).

About Dubai Calendar

Dubai Calendar, the official listings platform for events in the city, is managed by Dubai Festivals and Retail Establishment (DFRE), an entity of Dubai Department of Economy and Tourism (DET). A free resource online and via a dedicated mobile app, Dubai Calendar is the city’s go-to guide that allows residents and tourists to discover all the events, festivals and experiences Dubai has to offer, from arts, culture and education to food, sports and shopping. With more than 1,200 events per year, and new listings added every week, Dubai Calendar is an all-access pass to ‘what’s on’ in Dubai. For more information about events taking place across Dubai, please visit: www.visitdubai.com/en/whats-on/dubai-events-calendar.

Source: Zawya.