By the time you read this, Cape Town’s minibus taxi (matatu) strike should be over. Nevertheless, the impact of the strike, which as I write has been ongoing for four-days, will continue to be felt for quite a while.

The people who suffered the most were the general public, most of whom use the taxis to get in and out of Cape Town for work.

On the day the taxi strike began, thousands of commuters were caught off guard and forced to walk home in the cold and dark of a typical winter evening.

The taxis went on strike following clashes in the week after the City Council began enforcing new traffic by-laws. The new rules allow them to impound vehicles in cases where drivers cannot produce a valid operating licence, or are found to be operating contrary to the conditions of their operating licence.

The councillor in charge of Cape Town’s Safety and Security department, is a hard headed, thick-skinned, no-nonsense type who appears to relish fighting the taxi industry.

For instance, when the trouble hit, the councillor poured oil on the fire.

He said: “I have been asked by the mayor to ensure that the violence caused by some in the public transport sector is met with an appropriate response, and to remind them that we will proceed with impounding 25 vehicles for every truck, bus, vehicle or facility that is burnt or vandalised.”

Of course, as is usual when there is any sort of public unrest anywhere in Africa, our supposed friends in Western capitals are quick to issue travel alerts to their citizens, warning them not to visit.

Even when as in Cape Town, Nairobi and elsewhere, tourists are often the least affected people in such situations.

Let’s face it, few if any tourists use public transport in the way locals do.

Also, since most of them come from countries where they have experienced public disturbances, such as protests and riots, they should have the sense to stay behind closed doors until the storm passes, or in this case, in their hotels and Airbnbs.

The UK, where they have had their fair share of protests in recent months on issues from cost of living to the environment, appears to have been one of the first to issue a travel advisory to its people who were planning to visit Cape Town.

Considering that the UK is one of the biggest tourism markets, this travel alert is of particular concern. It may well dramatically reduce the number of tourists visiting Cape Town and the Western Cape just as tourism was beginning to think things were looking up.

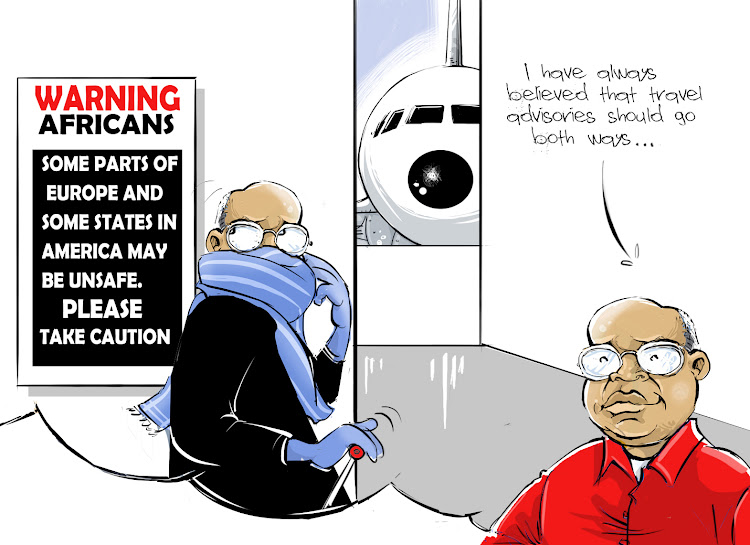

That said, I have always believed such travel alerts should go both ways. I have yet to see South African or, for that matter, Kenyan authorities issuing travel alerts for situations in Europe or North America, even though they should.

It needn’t be some sort of tit-for-tat reaction.

For instance, in May, seven countries issued advisories warning their citizens about gun violence when travelling to the US. They are Australia, Britain, Canada, France, New Zealand, Uruguay and Venezuela.

At the moment, the US itself has Level 2 warnings that advise travellers to “exercise increased precautions” in 51 countries, ranging from some of their closest allies (such as France, Germany, Italy, Spain, Sweden and the UK) to the usual suspects.

In this case, the usual suspects are countries that depend a lot on tourism for income, such as Gambia, Kenya, Madagascar, Malawi, Mozambique, South Africa and Tanzania.

Others are Brazil, Indonesia, Morocco, Oman, Tunisia, Turkey, Turks and Caicos and the United Arab Emirates.

Of course, travel advisories can also come from within. For instance, in May, a US Civil rights group issued a travel advisory for Black tourists visiting Florida. The advisory came from the National Association for the Advancement of Coloured People, specifically, the president of the Tallahassee branch.

The advisory said Florida is openly hostile toward African Americans, people of colour and LGBTQ+ individuals.

Source: The Star