In an era where technology has seamlessly woven itself into the fabric of our daily lives, the travel industry stands at the intersection of innovation and complexity. Amidst the excitement of planning vacations and exploring new destinations, the intricate web of payment processing challenges often go unnoticed. In this comprehensive blog, we will delve into the nuances of payment processing in the travel industry, unraveling the complexities that both businesses and consumers encounter.

- Cross-Border Payment Friction —

One of the foremost challenges faced by the travel industry in payment processing is the complexity of cross-border transactions. As travelers jet off to explore new horizons, payments traverse international borders, encountering diverse currencies, regulations, and financial systems. This intricacy often leads to currency conversion issues, delayed transactions, and additional fees, leaving both consumers and businesses grappling with a less-than-optimal payment experience.

Solutions:

Multi-Currency Support: Implementing payment systems that seamlessly support multiple currencies can mitigate the impact of currency conversion issues, providing users with a transparent and hassle-free payment experience.

Regulatory Compliance: Staying abreast of and adhering to international financial regulations is crucial. Collaborating with payment processors well-versed in cross-border compliance can help navigate the complex regulatory landscape.

- Fraud Risks and Security Concerns —

As online transactions surge, so do the risks associated with fraud and security breaches. The travel industry, with its high-value transactions and vast array of customer data, becomes a lucrative target for cybercriminals. From stolen credit card information to identity theft, the potential consequences of inadequate payment security measures are significant.

Solutions:

Tokenization: Employing tokenization technology can enhance security by replacing sensitive payment information with unique tokens. This minimizes the risk of data breaches and ensures that customer data remains protected.

Two-Factor Authentication (2FA): Implementing robust authentication processes, such as 2FA, adds an extra layer of security, making it more challenging for unauthorized individuals to gain access to sensitive information.

- Dynamic Pricing and Transparent Payments —

The dynamic nature of pricing in the travel industry, with fluctuating fares and real-time availability, poses a unique set of challenges in payment processing. Consumers expect transparency in pricing, and any discrepancies or hidden fees can lead to dissatisfaction. Ensuring a seamless payment experience amidst the constantly evolving pricing landscape requires innovative solutions.

Solutions:

Real-Time Price Adjustments: Implement systems that dynamically adjust prices in real-time, ensuring that customers are charged accurately based on the latest information, and transparency is maintained throughout the booking process.

Clear Communication: Providing clear communication on pricing details, including taxes and fees, helps build trust with customers. Transparent payment processes contribute to a positive user experience and can lead to increased customer loyalty.

- Mobile Payments and User Experience —

The ubiquity of smartphones has transformed the way people interact with businesses, including travel services. Mobile payments have become a cornerstone of the industry, but optimizing the user experience on mobile platforms presents its own set of challenges. From responsive design to intuitive interfaces, ensuring a seamless mobile payment experience is imperative for customer satisfaction.

Solutions:

Mobile-Optimized Interfaces: Designing user interfaces specifically tailored for mobile devices enhances the overall payment experience. Intuitive navigation and responsive design contribute to smoother transactions on smartphones and tablets.

Mobile Wallet Integration: Embracing popular mobile wallets and payment apps streamlines the payment process. Integrating options like Apple Pay, Google Pay, and others caters to the preferences of mobile-savvy travelers.

- Integration with Emerging Technologies —

The rapid evolution of technology introduces both opportunities and challenges for the travel industry. Integrating with emerging technologies such as blockchain, artificial intelligence (AI), and machine learning (ML) can revolutionize payment processing but requires careful consideration and strategic planning.

Solutions:

Blockchain for Security: Leveraging blockchain technology can enhance security and transparency in payment transactions. Blockchain’s decentralized nature reduces the risk of fraud and ensures the integrity of financial transactions.

AI and ML for Fraud Detection: Implementing AI and ML algorithms can strengthen fraud detection mechanisms. These technologies can analyze patterns, detect anomalies, and adapt to evolving threats, providing a proactive approach to security.

- Regulatory Compliance and Legal Complexities —

The travel industry operates on a global scale, subject to a myriad of regulations and legal frameworks. Ensuring compliance with diverse international and local laws poses a significant challenge for payment processors and businesses alike. Failure to navigate these regulatory waters diligently can result in legal consequences, fines, and reputational damage.

Solutions:

Legal Consultation: Collaborating with legal experts specializing in international payment regulations can provide invaluable insights. Establishing a robust legal framework ensures that payment processes align with the various compliance requirements across regions.

Regular Compliance Audits: Conducting regular compliance audits helps identify any gaps or changes in regulations. Staying proactive in adapting to evolving compliance standards minimizes the risk of legal complications.

- Chargebacks and Dispute Resolution —

Chargebacks, often stemming from customer dissatisfaction, unauthorized transactions, or fraud, are a common concern for the travel industry. Disputes can lead to financial losses, strained customer relationships, and added administrative burdens. Resolving chargebacks efficiently is crucial to maintaining a positive payment ecosystem.

Solutions:

Effective Communication: Establishing clear communication channels with customers can prevent misunderstandings that may lead to chargebacks. Timely and transparent communication regarding policies, refunds, and dispute resolution can foster trust.

Robust Documentation: Maintaining thorough documentation of transactions, including booking confirmations, terms of service, and customer communications, strengthens the merchant’s position in case of disputes.

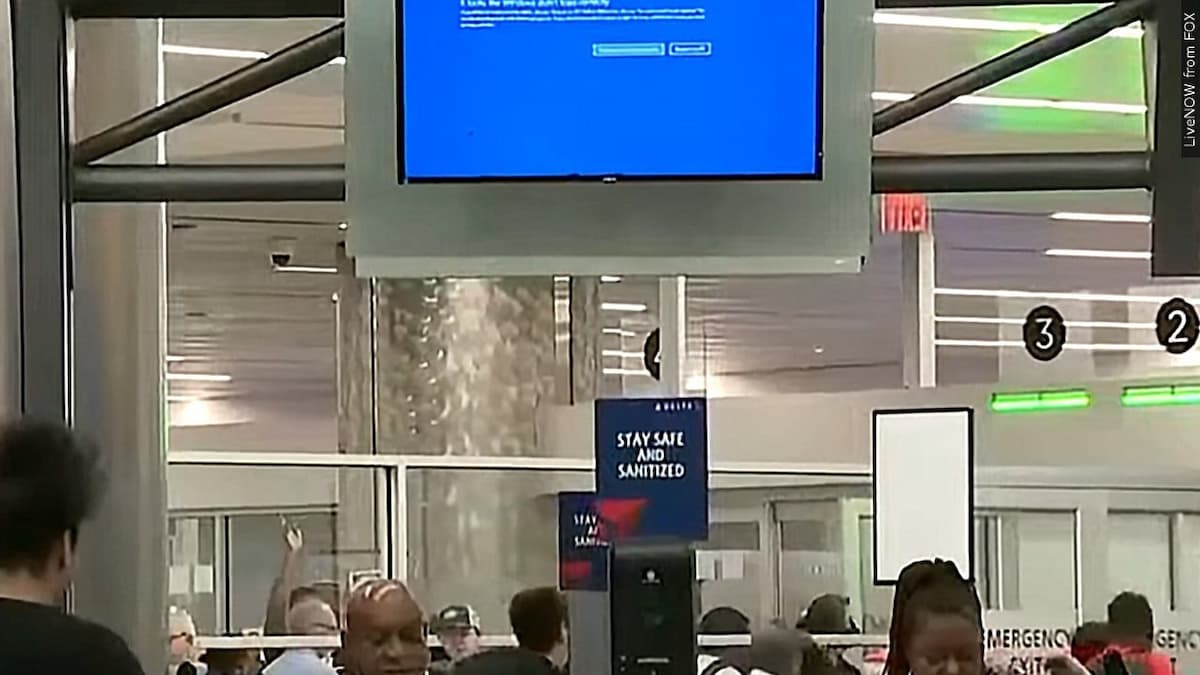

- Infrastructure Scalability and Reliability —

The travel industry experiences fluctuations in demand, especially during peak seasons and special events. Payment processing systems must be scalable to handle sudden spikes in transactions without compromising speed and reliability. Downtime or processing delays can have severe consequences, affecting customer satisfaction and revenue.

Solutions:

Cloud-Based Solutions: Utilizing cloud-based payment processing systems allows for scalability and flexibility. Cloud infrastructure can handle increased transaction volumes during peak periods, ensuring a seamless payment experience for customers.

Redundancy and Failover Mechanisms: Implementing redundancy and failover mechanisms in payment systems ensures uninterrupted service. Redundant servers and backup systems can mitigate the impact of hardware failures or other technical issues.

- Collaboration and Interoperability —

The travel industry consists of a complex ecosystem of service providers, including airlines, hotels, travel agencies, and payment processors. Ensuring seamless collaboration and interoperability between these entities is essential for a cohesive payment experience. Incompatibility or communication breakdowns can lead to inefficiencies and errors in transaction processing.

Solutions:

Standardized Protocols: Adhering to industry-standard protocols for data exchange facilitates interoperability between different components of the travel ecosystem. This ensures that information flows seamlessly across various platforms.

Collaborative Partnerships: Establishing strong partnerships and collaborations between travel service providers and payment processors enhances communication and interoperability. Shared platforms and integrated systems can streamline payment processes.

Conclusion —

In conclusion, the payment processing challenges faced by the travel industry are multifaceted, requiring a holistic and strategic approach. From cross-border complexities to security concerns and regulatory hurdles, addressing these challenges demands a combination of technology adoption, regulatory compliance, and a commitment to customer satisfaction.

The industry’s future success hinges on its ability to adapt to emerging technologies, foster collaboration, and prioritize the security and transparency of payment processes. As we navigate the ever-evolving landscape of global travel, overcoming these challenges will not only enhance the efficiency of payment processing but also contribute to a positive and memorable experience for travelers worldwide. The journey toward a seamless payment horizon in the travel industry is ongoing, marked by innovation, resilience, and a dedication to elevating the overall travel experience.

Source: Pulse