Kenya and South Africa, some of the two strongest economies on the African continent, have agreed to reduce barriers to cross-border movement by allowing visa free travel between them.

The pact agreed upon by Kenya’s President William Ruto and his South African counterpart on November 9, 2022, will resolve a long-standing visa dispute between the two countries. With the formalisation, Kenyans will, from January 2023, be eligible for visa free travel to South Africa for up to three months (90 days) in a calendar year.

Already, South Africans get free visas on arrival in the East African nation, a gesture Kenyans have wanted to be reciprocated for a long time. For Kenyans travelling to South Africa, they were required to pay US$40 for the visa while they also had to provide proof they had sufficient funds and had booked return flight tickets.

The Kenya and South Africa visa deal will take effect on January 1, kicking off the visa free travel arrangement.

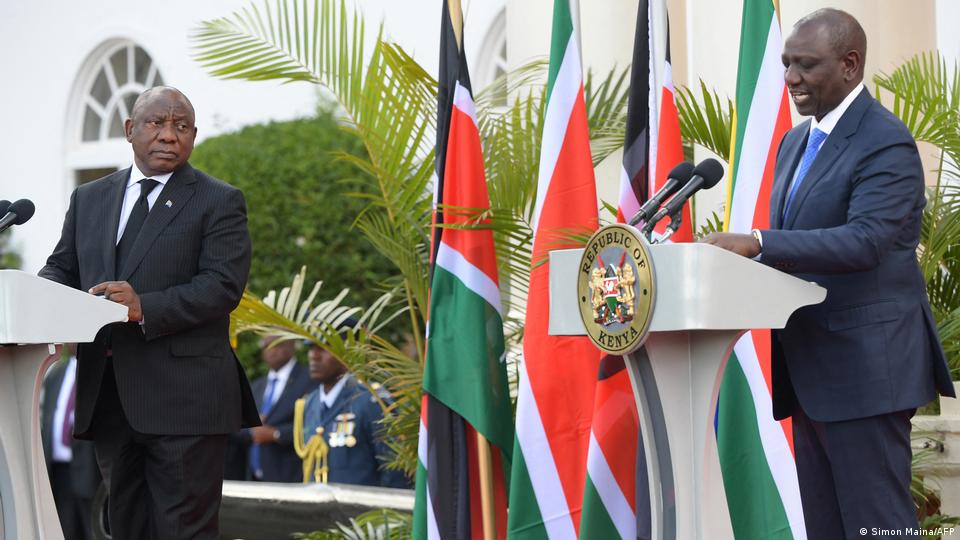

At the time of the announcement, South African President Cyril Ramaphosa was in Kenya for his first official trip to the country at the invitation of President Ruto.

Ramaphosa said they discussed the visas issue between Kenya and South Africa to allow Kenyans to visit the Southern African nation visa-free basis.

“This will officially start on January 1, 2023, and it will be available to Kenyans for a 90-day period per year,” he said.

In addition, the Kenyan and South African leaders directed their respective trade ministers to work on removing barriers limiting trade between the two African countries. The two countries are also working to address trade barriers to increase business and trade cooperation which will now be easier with visa free travel.

Following a meeting between Presidents Ruto and Ramaphosa, they said that Kenya and South Africa will deal with non-tariff barriers like the bureaucracy in licensing, regulation restrictions and sanctions which will allow the opening up for business in industries, export of agricultural produce and logistics.

The two leaders signed four instruments, and the removal of the trade barriers agreement was part of this to foster cooperation.

President Ruto said that with his counterpart they agreed to develop a sustainable mechanism for the identification, monitoring and resolution of non-trade barriers that limit trade potential between Kenya and South Africa.

Additionally, three memoranda of understanding between Kenya and South Africa were signed and a cooperation of correctional sciences agreement was inked on housing and human settlement and cooperation between the Kenya School of Government and the South African National School of Governments on audio-visual co-production.

The decision to allow Kenyans visa-free travel to South Africa could boost Kenya’s passport which was ranked among the favourite passports in Africa in July by the Henley Passport Index Report.

Kenya was ranked 76th globally, having improved by one point from 77th last year.

The Henley Passport Index mobility score stood at 72. The score measures the number of countries a passport holder from a certain nation can travel to without a visa.

In Africa, the Kenyan passport was ranked the most powerful after Seychelles, Mauritius, South Africa, Botswana, eSwatini, Malawi and Lesotho.

Even as Kenya and South Africa relax their visa requirements, Africans continue harbouring hope that there will be an African Passport for every African to enable visa free travel on the continent.

An African passport would be instrumental in relaxing travel restrictions and breaking barriers in mobility and intra-African trade.

The African passport is a flagship project of the African Union (AU)’s Agenda 2063, which envisions an integrated continent that is politically united and based on the ideals of Pan-Africanism with the vision of Africa’s Renaissance.

An African passport would help collapse both physical and invisible barriers that have thwarted and limited the integration of the African people. It would be a key component of the African Continental Free Trade Area (AfCFTA) which could immensely benefit from visa free travel.

To test the systems, the AU unified African passport was launched in July 2016 at the 27th Ordinary session of the AU held in Kigali, Rwanda. It was scheduled to be availed to Africans by 2020, but with the pandemic, the plans seem to have been shelved.

Currently, only AU officials, diplomats and government leaders have been issued the passport, which holds the potential to bring down Africa’s physical barriers to visa free travel.

On successful launch, the African passport will become a common document that will replace the nationally issued AU member states’ passports. It will exempt bearers from having to obtain any visas for all 55 African states easing visa free travel.

Just like it has been happening with nationally issued documents, the three types of AU passports to be issued will include the Ordinary Passport, which is 32 pages and valid for five years. This document will be issued to citizens intended for occasional travel like business trips and vacations making visa free travel a reality.

Government institutions with officials travelling on official business will be issued the official or Service passport will be issued to officials attached to.

At the same time, the two leaders hailed Ethiopia’s peace agreement signed last week brokered by the African Union in South Africa.

Ruto and Ramaphosa appealed to the Ethiopian parties to fully implement the agreement for a lasting political settlement.

Source: The Exchange