Before you pack your bags for your next trip, take a moment to plan and acquire the right travel insurance.

In Summary

- Road trips have become a popular weekend activity for individuals and friends, who often drive to neighbouring counties and towns in countries like Uganda and Tanzania.

- Kenyan companies have capitalised on these developments by adapting travel products that cater to various market groups.

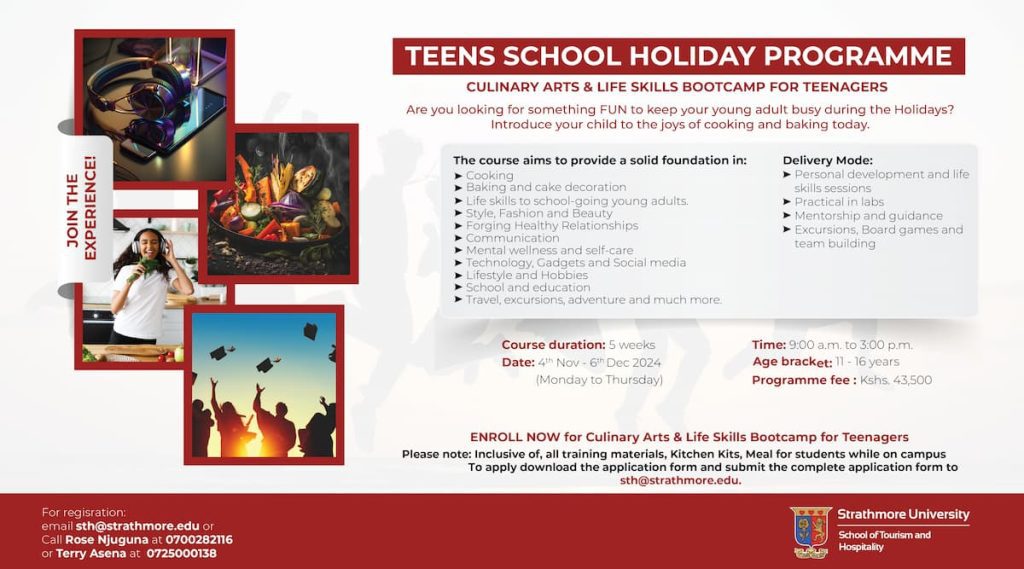

In recent times, significant investments in road, railway, and air transport have revolutionised mobility across East Africa.

Kenyan companies have capitalised on these developments by adapting travel products that cater to various market groups.

Road trips have become a popular weekend activity for individuals and friends, who often drive to neighbouring counties and towns in countries like Uganda and Tanzania.

Families now routinely plan holidays well in advance, especially to popular coastal regions like Mombasa and Diani, thanks to the convenience provided by the Madaraka Express railway service and the modernization of the Nairobi-Mombasa road.

ADVERTISING

Additionally, annual religious events have also spurred inter-regional travel, with Kenya, Rwanda and Uganda benefiting greatly from this.

For instance, Uganda’s Martyr’s Day attracts pilgrims from across the region to Namugongo, while the Kigali Genocide Memorial Centre is a popular visit destination for many Kenyans.

Furthermore, the visa-free agreement between Kenya, Uganda, and Rwanda has facilitated extended stays for Kenyans across the region, whether for business, tourism, or education.

The completion of the 500-kilometre Standard Gauge Railway has also opened up tourist resort cities such as Kilifi and Lamu, enhancing local tourism

Looking into the future, discussions to open up Africa’s 54-country borders courtesy of the Africa Continental Free Trade Area are expected to revolutionise travel at an unprecedented scale, expanding travel bucket lists and tourism numbers across different countries.

This surge in travel underscores the importance of travel insurance.

It’s often seen as an unnecessary expense, but it can be a lifesaver in case of unforeseen circumstances.

It provides a financial shield, allowing you to enjoy your trip without worrying about the loss emanating from travel-related potential risks.

With coverage spanning from medical expenses, emergency evacuations, trip cancellations, and lost luggage, you have the assurance of protection in the event of unforeseen occurrences.

One of the lesser-emphasised benefits of travel insurance is the 24/7 assistance service, which can help with lost passports, legal matters, or other emergencies, and even offer third-party aid to make your travel smoother and more enjoyable.

This service ensures that travellers have access to support at any time, no matter where they are in the world.

For instance, if you misplace your passport, the assistance service can guide you through the process of obtaining a replacement quickly.

In case of legal issues, they can provide advice or connect you with local legal experts.

Additionally, travel insurance can assist one in taking care of medical emergencies by coordinating with local healthcare providers and arranging for necessary treatments.

Travel activities like hiking, skiing, or scuba diving increase the risk of accidents.

Travel insurance also provides peace of mind by reducing anxiety and stress levels, allowing travellers to enjoy their journey knowing they are protected against anticipated risks.

It also ensures unexpected costs don’t derail your travel plans and budget.

Remember the specific coverage offered by travel insurance policies can vary greatly.

It’s essential to read the policy carefully and choose one that aligns with your travel plans and needs.

Before you pack your bags for your next trip, take a moment to plan and acquire the right travel insurance.